Looking for something more in-depth?

We offer:

- Financial Education

-

One-on-ones

- Workshops

- Courses

- Outreach

- Partnership

Contact us today to find out what we can do for you!

Learn More About Financial Development

Learn More About Financial Development

Homeownership: Knowing Your Numbers Can Make the Difference

By Charlestien Harris I have been scanning the news lately and have read several articles about the housing market during this pandemic. To most analysts’ surprise, the housing market has been booming. According to the latest data the fixed interest rates for a...

A Good Credit Score: What Is It and What Does It Mean?

I am often asked what a good credit score is. Having a good score is important, but managing your finances, setting goals and living within your means is equally important. There is no absolute standard that creditors use to approve or deny credit. ...

How to Recognize Credit Repair Scams

By Charlestien Harris During this COVID-19 pandemic, I have noticed numerous credit repair ads popping up on social media and in other news outlets. It is so very important to remember that thieves are out to get all they can get when it comes to cashing in on...

Home Improvements: Super Saver Edition

Hey Super Saver friends! I haven’t written a blog post in about two months, so I thought it would be nice to start my post with a life update mid-pandemic. Life has definitely looked a little different these past few months. I have been working from home since March,...

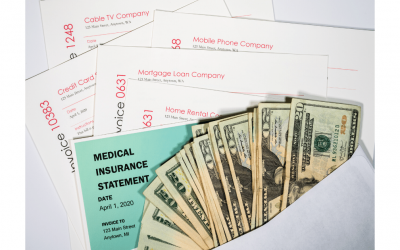

How Late Payments Affect Your Credit Score

By Charlestien Harris Often I hear people ask, “Why is it so important for me to pay my bills on time? As long as they get my money they should be satisfied.” While it is true you have paid your creditor what you owe them, the fact of the matter is there...

Credit Reports and Scores Explained in Simple Terms

By Charlestien Harris Having access to credit can make dreams come true. In today’s world, you can hardly conduct business without using credit, rather it be renting a vehicle or hotel room or making a large purchase. Most people don’t worry about...

The Great Coronavirus Pandemic of 2020

By Jayla Wilson I have seen and laughed at numerous memes about how so many of us thought 2020 was going to be our best year yet and coronavirus said, “You want to bet?” While I know this pandemic has thrown a wrench in many of our plans, I encourage you not to give...

Debt Management: Do it yourself or Pay A Company

By Charlestien Harris While watching the news and scanning Facebook, I have noticed numerous advertisements for debt management companies. With ads promising easy debt relief, these programs are tempting to anybody struggling to stay on top of debt. The question...

What Happens If I Can’t Pay My Bills

By Charlestien Harris When managing finances, the number one priority is to keep current with your mortgage or rent, as well as your monthly household bills. There are many factors that can affect your ability to stay current with bills such as death, job loss,...