Looking for something more in-depth?

We offer:

- Financial Education

-

One-on-ones

- Workshops

- Courses

- Outreach

- Partnership

Contact us today to find out what we can do for you!

Learn More About Financial Development

Learn More About Financial Development

A Big Idea: Banking on Building Empathy

By James Owen Most of us don’t think twice about how easy it is to access money. If you’re like me, it’s so easy you can do it before your first cup of coffee. Select, swipe, sip. But for too many Arkansans, just accessing their money is a challenge. Nationally, seven...

Talking about Poverty: Food Costs in the 1950s

By Kathryn Hazelett Editor’s note: This is the third in a series of blog posts to critically examine how poverty is defined, measured, and talked about, and how those conversations influence public policy. I know, I know. We’ve been talking about poverty. Why are we...

Pay Day Super Saving

Have you ever looked at the calendar and been excited to see five Fridays or perhaps even five Wednesdays in a month? For many of us, that excitement comes from knowing we’re going to receive an “extra” paycheck. Those who get paid bi-weekly (depending on which day of...

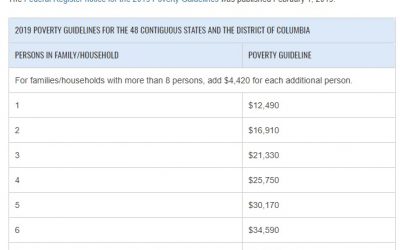

Talking about Poverty: Measurement

By Kathryn Hazelett Editor’s note: This is the second in a series of blog posts to critically examine how poverty is defined, measured, and talked about, and how those conversations influence public policy. Last week, we started our series on poverty with a discussion...

Talking about Poverty: Basic Needs

By Kathryn Hazelett Nearly 225,000 families live below the poverty line in Arkansas and Mississippi.[1] While we hear and talk about poverty a lot, we’re not always talking the same language. This is the first post in a series looking at how we define poverty, how we...

Ship Shape: How to Batten Down the Hatches Against Data Piracy

This month’s blog post is written by guest author James Owen. Read below to see how James is using the Equifax and Capital One data breaches as an opportunity to survey, secure and strengthen his credit and financial foundation. Despite my careful privacy moves, I’ve...

Back to School Super Saving

I know what you are thinking: Where did the summer go? For many of us, school will start in just a couple of weeks, and believe it or not, you can actually save money while doing your back to school shopping! Keep reading for some tips for saving money and time as you...

Tax-time Savings: A New Whitepaper and a Call to Action

By Janie Ginocchio As discussed in previous blog posts, income tax time is a good opportunity to encourage people to save, as tax refund checks are often the largest lump sum payment a household will receive all year. Southern Bancorp encourages savings at tax...

Super Summer Saving

It’s Summer! While most of us are still at work, our kids want to stay busy too. In this blog, I will tackle some budget friendly activities that you can do with your family this summer. But first, let’s start with planning for next year. Dependent Care Many companies...