Looking for something more in-depth?

We offer:

- Financial Education

-

One-on-ones

- Workshops

- Courses

- Outreach

- Partnership

Contact us today to find out what we can do for you!

Learn More About Financial Development

Learn More About Financial Development

Census 2020: Be Counted!

By Kathryn Hazelett Every 10 years, the United States counts its people – all of them. This is the census and it’s happening again in 2020. There is an entire government entity centered on the census – it’s that important. The census looks not only at the number of...

Advocacy 101: Local Decision Makers

By Kathryn Hazelett Editor’s note: This is the final entry in a series of blog posts about the legislative process on the state, federal, and local levels, and what you can do to help create and influence policy as a citizen. Entries from the rest of the series are...

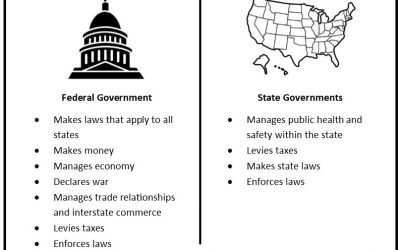

Advocacy 101: Federal Decision Makers

By Kathryn Hazelett Editor’s note: This is the fourth in a series of blog posts about the legislative process on the state, federal, and local levels, and what you can do to help create and influence policy as a citizen. Entries from the rest of the series are linked...

Advocacy 101: State Decision Makers in Mississippi

By Kathryn Hazelett Editor’s note: This is the third in a series of blog posts about the legislative process on the state, federal, and local levels, and what you can do to help create and influence policy as a citizen. Entries from the rest of the series are linked...

Every Budget Needs a Blueprint

They say the first step to solving a problem is admitting you have one. This time last year, I was in complete denial about having a spending problem. That is until my financial advisor, Southern Bancorp, Inc. CEO Darrin Williams told me to start tracking all of my...

Advocacy 101: State Decision Makers in Arkansas

By Kathryn Hazelett Editor’s note: This is the second in a series of blog posts about the legislative process on the state, federal, and local levels, and what you can do to help create and influence policy as a citizen. Entries for the rest of the series are linked...

Advocacy 101: Ideas to Implementation

By Kathryn Hazelett Editor’s note: This is the first in a series of blog posts about the legislative process on the state, federal, and local levels, and what you can do to help create and influence policy as a citizen. Entries for the rest of the series are linked at...

Spend Less, Travel More, Save Big: Tips from a Super Saver

Its May, which means school is almost out and vacation time is almost here! As you might have guessed, one of my favorite things to do before going on vacation is to plan to save as much as possible! In fact, I saved big on a recent spring break trip to Pigeon Forge,...

It’s Time for Less Spending and More Wealth Building

I’ve often been told not to refer to myself as “broke”. Understandable, since the definition of the word is to be penniless, poverty-stricken and completely out of money. Yet, it can certainly feel that way when you can’t really afford the lifestyle you want. Hi! My...