Down Payment

Closing Costs

Home Repairs

We believe that building generational wealth through homeownership is one of the most important things a person can do for their future.

1. Check Your Eligibility

- To be eligible for matched savings, your current home address or the address of the home you plan to purchase must be located within the program eligible zone.

2. Apply

Once eligible, the following documents will be required during the application process:

- A valid state-issued photo ID (state ID, driver’s license, U.S. passport, or military ID)

-

Social Security number

-

Proof of current homeownership or proof you are in the process of purchasing (property card from assessor’s office, copy of deed, or letter from mortgage lender)

3. Open Your Account & Start Saving!

- After completing the application, you will receive instructions on how to open your account. Then, start saving!

4. Complete an eHome America Financial Management Course

- After opening your account, you must complete a eHome America online Financial Management Course which costs approximately $99. You will be reimbursed for this expense once you have completed the course. For questions, please reference the FAQs.

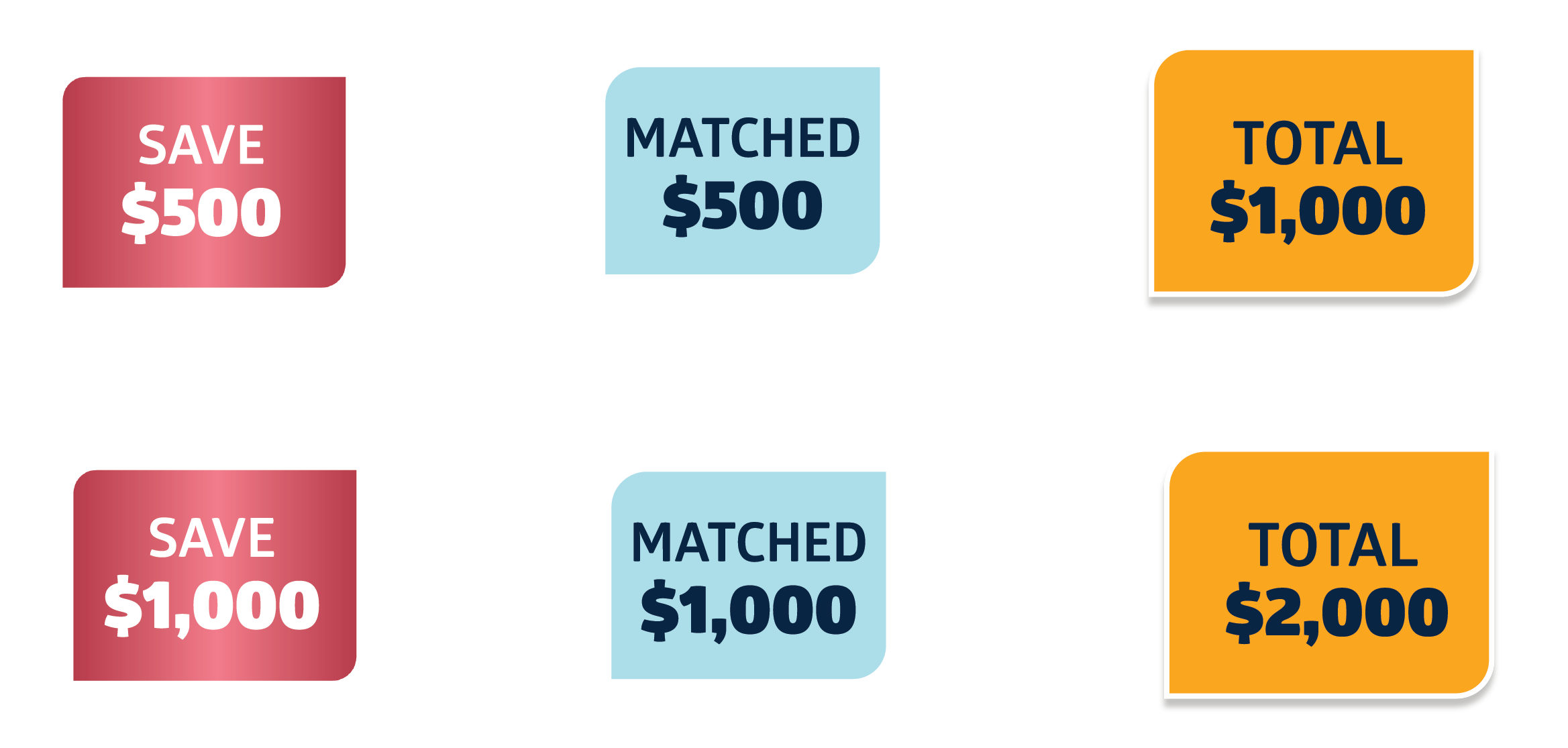

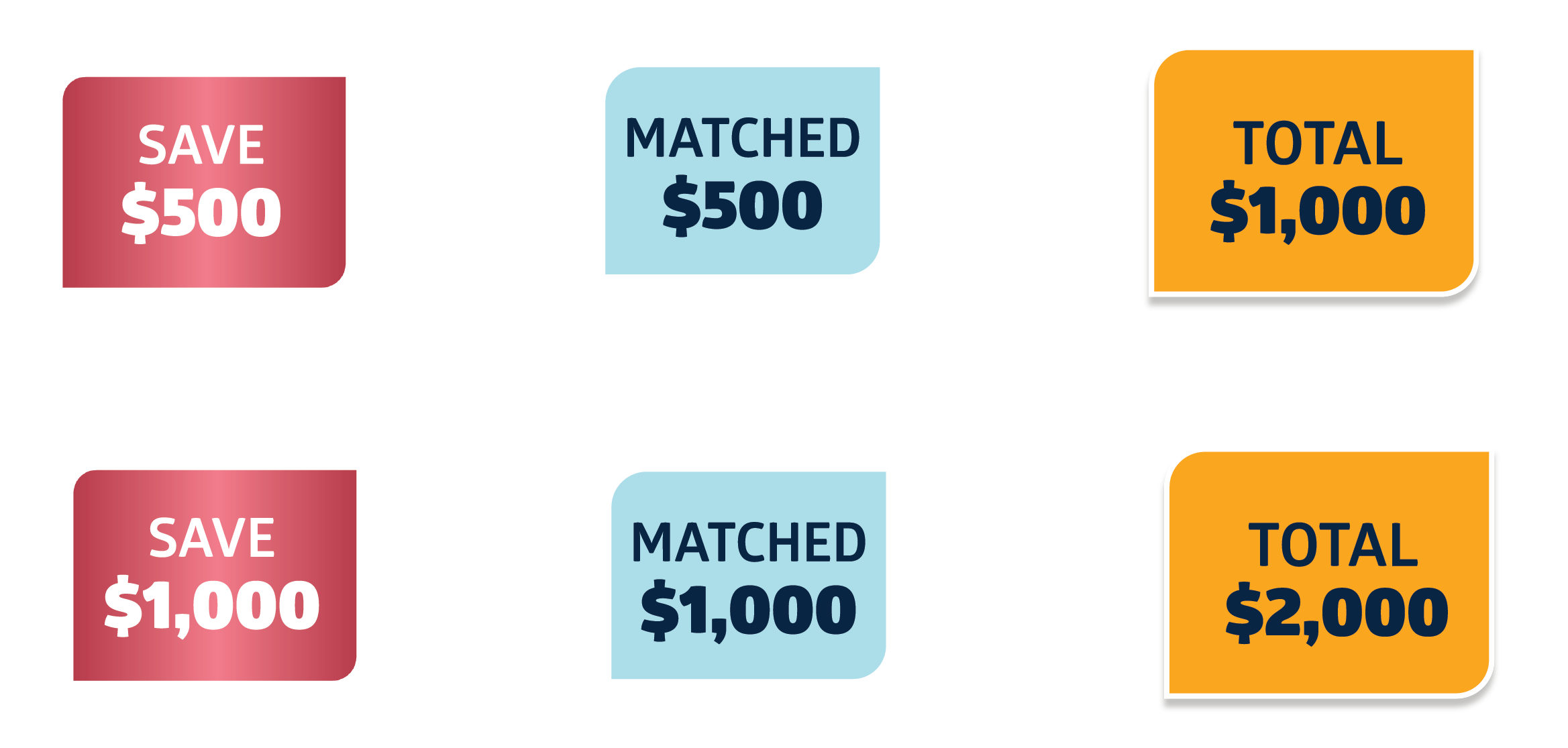

The total funds after match ($1,000 or $2,000) may be used for the following:

- Down Payment for home purchase

- Closing Costs for home purchase

- Home Repair(s) to an existing or new home

To determine your program eligibility, complete the form below. If eligible, you’ll be able to begin the application process immediately. If you are not eligible, you will be notified after completing this form.

What qualifies as a repair?

Renovations, repairs, additions, landscaping, energy efficiency upgrades, appliances, fixtures, and shutters.

Can the funds be used for a rental, or does it have to be my primary residence?

Use of funds is for owned primary residences only.

How long do I have to save?

Is there a minimum saving time?

When does the savings time period start?

When/how do I get my financial course reimbursement?

If I pay and complete the course but don’t save the money, do I get my reimbursement?

Is the course pass/fail OR just complete.

How often do I have to make a savings contribution?

How much do I need to open the account?

$20

Down Payment

Closing Costs

Home Repairs

Down Payment

Closing Costs

Home Repairs

We believe that building generational wealth through homeownership is one of the most important things a person can do for their future.

1. Check Your Eligibility

To be eligible for matched savings, your current home address or the address of the home you plan to purchase must be located within the program eligible zone.

2. Apply

Once eligible, the following documents will be required during the application process:

-

A valid state-issued photo ID (state ID, driver’s license, U.S. passport, or military ID)

-

Social Security number

-

Proof of current homeownership or proof you are in the process of purchasing (property card from assessor’s office, copy of deed, or letter from mortgage lender)

3. Open Your Account & Start Saving!

- After completing the application, you will receive instructions on how to open your account. Then, start saving!

4. Complete a Financial Management Course

- After opening your account, you must complete a eHome America online Financial Management Course which costs approximately $99. You will be reimbursed for this expense once you have completed the course. For questions, please reference the FAQs.

The total funds after match ($1,000 or $2,000) may be used for the following:

- Down Payment for home purchase

- Closing Costs for home purchase

- Home Repair(s) to an existing or new home

To determine your program eligibility, complete the form below. If eligible, you’ll be able to begin the application process immediately. If you are not eligible, you will be notified after completing this form.

What qualifies as a repair?

Renovations, repairs, additions, landscaping, energy efficiency upgrades, appliances, fixtures, and shutters.

Can the funds be used for a rental, or does it have to be my primary residence?

Use of funds is for owned primary residences only.

How long do I have to save?

Is there a minimum saving time?

When does the savings time period start?

When/how do I get my financial course reimbursement?

If I pay and complete the course but don’t save the money, do I get my reimbursement?

Is the course pass/fail OR just complete.

How often do I have to make a savings contribution?

How much do I need to open the account?

$20

Email us At IDA@banksouthern.com