INDIVIDUAL DEVELOPMENT ACCOUNT

Housing | Education | Entrepreneurship

INDIVIDUAL DEVELOPMENT ACCOUNT

Housing | Education | Entrepreneurship

A savings program brought to you by:

A savings program brought to you by:

Now Taking Applicants in Arkansas!

Accounts are limited, apply today!

What is an Individual Development Account (IDA)?

Accounts are specifically used to make qualifying asset purchases like buying a home, improving or repairing your home, starting a business, or paying for school or training.

IDAs are FDIC insured accounts opened and maintained in Southern Bancorp Bank using matched funds provided through the Arkansas Department of Human Services/Temporary Assistance for Needy families program.

Wait… is this real?

Yes! The IDA program is made possible with funding from the Arkansas Department of Human Services and is designed to help Arkansans build strong financial futures.

Accounts are opened and maintained with Southern Bancorp Bank, an FDIC insured community development financial institution (CDFI) based in Arkansas, with program management by Southern Bancorp Community Partners, a nonprofit financial development organization.

who is eligible?

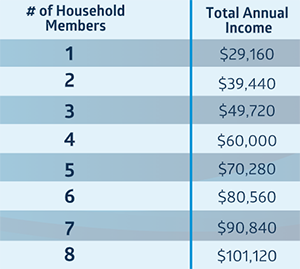

The program is open to income-qualified Arkansas residents (see the chart below) with at least one dependent under the age of 18. Your net worth resources must total less than $10,000 (these could include 401ks and IRAs, checking or savings accounts, or anything that can be converted to cash quickly other than your home or vehicle).

INCOME Requirements

For each additional member of a household, add $10,280

SHOULD I WAIT TO APPLY?

No! The program is open for a limited time for a limited number of applicants on a first come, first served basis. Once the program’s funding runs out, eligible applicants will be placed on a waiting list for future IDA openings, though funding is not guaranteed, so don’t wait!

how does it work?

Complete the eligibility form below. If you meet the criteria, you’ll be able to begin the application process. You’ll need to have a few items available to upload, so if you need to come back to the application, you can always click “Save and Continue” and receive an emailed link to the form so you can pick up where you left off.

Once the application is complete, an IDA Program Officer will contact you with instructions for opening your IDA account, which is an FDIC insured savings account at Southern Bancorp Bank. You can open yours in person at one of Southern Bancorp’s Arkansas locations (banksouthern.com/locations) or an account opening specialist will reach out with instructions for opening remotely. Your account will automatically close at the end of the IDA process when your funds have been distributed.

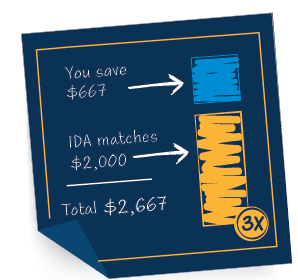

Start saving! You can save over time or if you’ve already saved, you can deposit the full amount to be matched ($667) into your IDA account immediately. Note that you will always have complete access to your saved money and may close the account or withdraw the unmatched portion at any point you no longer wish to participate.

Your IDA Program Officer will then provide you with either an online or in person option for completing the required three (3) hours of financial counseling, and once you’ve done that, you’re ready for your match!

Your matched amount (up to $2,000) is not placed into your IDA account, but instead will be sent directly to the vendors providing you services. For example, if you’re using your matched funds to pay for school, we will send the required amount directly to the school. If it’s for purchasing your home, we will send the money to your closing agent. If it’s for home repair, we’ll pay your licensed contractor directly. Your IDA Program Officer can answer all your questions about different payment options.

Check Your Eligibility:

To determine your eligibility, complete the form below. If eligible, you’ll be able to begin the application process immediately. A link to the application will also be e-mailed to you. Once complete, an IDA Program Officer will contact you about next steps. If you have questions, please email IDA@banksouthern.com.

Questions?

Please call 870.802.9145 or email IDA@banksouthern.com.