“Big banks are abandoning rural America for more profitable urban markets, leaving many communities without adequate access to capital. That’s why unique organizations like Southern Bancorp are more important than ever.”

- Former President Bill ClintonA Different Kind of Bank

From our mission to our markets, Southern Bancorp is a unique financial institution that was founded to help strengthen underserved communities through financial access and investment. By combining traditional banking and lending services with financial development tools ranging from credit counseling to public policy advocacy, Southern Bancorp helps underserved families and communities grow financially stronger – regardless of zip code.

Our Mission

Southern Bancorp’s mission is to create economic opportunity in underserved communities by providing responsible, responsive, and innovative financial products and services that balance profits with purpose.

Our Story

Thirty years ago, some of rural America’s most underserved and distressed communities gained an economic development partner when visionaries such as Bill Clinton, Rob Walton, Mack McLarty, the Winthrop Rockefeller Foundation and others formed the Southern Development Bank Corporation, today known as Southern Bancorp.

With an initial investment of approximately $10 million, and a mission to create economic opportunity, Southern Bancorp, Inc., along with its development partners – Southern Bancorp Bank and Southern Bancorp Community Partners, has grown to become one of the largest community development organizations in the United States, as well as a model for an entire industry of mission-focused financial institutions known as Community Development Financial Institutions or CDFIs. Today, Southern Bancorp is a $2.6 billion asset organization with over 65,000 customers and 56 branches located primarily in underserved markets in the Mid-South.

Southern’s focus is on growing its impact and influence through responsive, responsible, and innovative product delivery to the un/underbanked, as well as developing strategic partnerships that help broaden its impact far beyond its physical market borders such as with the CDFI Fund and the Global Alliance for Banking on Values (GABV).

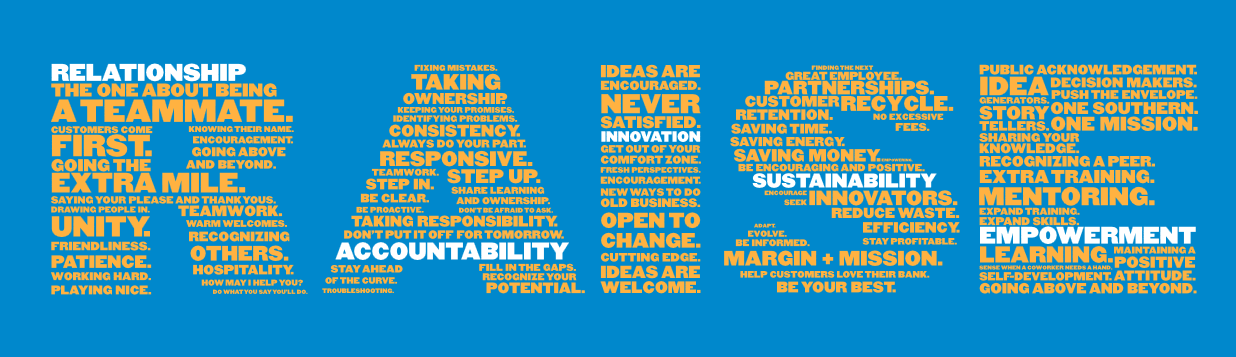

Our Values

Southern Bancorp believes mission-driven banking is also values-based banking, which is why our core values are a critical component of the value we create for our stakeholders. Living our core values provides us with the foundation needed to pursue and achieve our vision, and our employees are rewarded for exhibiting these values. As an institution dedicated to raising communities up, it’s only fitting that Southern’s core values reflect that same spirit: R.A.I.S.E.

Our Markets

Southern Bancorp’s target markets are primarily communities in which traditional brick and mortar financial access has dwindled or even disappeared, creating a void that at best leaves individuals without the capital needed to build assets and at worst opens the door to predatory lenders who may cause even further financial damage. These target markets may range from small, rural towns to urban communities lacking in providers, while our state and national policy activities have the potential to impact individuals anywhere in the United States.

Our Impact

For each category, we have created what we refer to as Big Hairy Audacious Goals – 10 year goals that maximize impact across our markets and beyond in three categories: supporting homeownership and housing by assisting individuals with capital and capacity, supporting jobs by facilitating entrepreneurship with capital and capacity, and supporting savings and asset accumulation by helping individuals to earn, keep and grow their assets.

2016-2026 Big Hairy Audacious Goals

Homeownership

20,000

people supported in attaining affordable housing

Entrepreneurship

120,000

jobs supported

Savings

2,000,000

people empowered to save